Our Veterans NYC

Connecting Our NYC Metro Veterans Community

Events

Monday

Apr 01

4/1/2024 The Bronx Vet Center Sergeant’s Time

Cost: Free

Join us for the next edition of SGTs Time for this month. These monthly virtual presentations are open to all eras of Veterans, genders, and caregivers. Come to learn and ask questions!

The Bronx Vet Center will host its next Sergeant’s Time presentation on APR 1st @ Noon. This month we will be speaking about: “The VA Service-Connected Matrix: Additional Benefits You May Be Eligible For”

Learn About:

Additional benefits that you may be eligible for that are based on a favorable decision for a VA benefit and/or based on special circumstances. These are also known as derivatives.

Sergeant’s Time

April 1st, 12:00pm – 1:00pm, virtually via Webex

The VA Service-Connected Matrix: Additional Benefits You May Be Eligible For

Click Here to Register!

If the above link won’t work on your browser try to cut and paste the full URL below:

https://veteransaffairs.webex.com/weblink/register/ra8516d628a4fd48a1a53729eae85b5e4

Website: https://veteransaffairs.webex.com/weblink/register/ra8516d628a4fd48a1a53729eae85b5e4

Virtual

4/1/2024 – 5/31/2024 Exit12 Participants for its Next Project in April and May

Cost: Free

*Please note 15-20 participants will be invited to join the project. Fill out the interest form asap*

Following last year’s Truths Colliding workshops, Exit12 and the Intrepid Museum are bringing together a group of veterans, military-connected individuals, and civilians for a series of movement workshops. Over six weeks, Exit12 will hold space for participants to share stories about their service. By sharing these stories we aim to build cross-cultural dialogue, empathy, and healing.

We are looking for military members, veterans, and their family members in the NYC metro area to join us for this project. Participants will receive a stipend and travel reimbursement for the workshop series and performance.

Please register your interest via this link

bit.ly/E12SoW_InterestForm

Workshops will be held at the Intrepid from 6:30pm – 8:30pm on the following dates:

April 22nd

April 29th

May 6th

May 13th

May 20th

Wednesday, May 29th or Thursday, May 30th (TBC)

The performance is scheduled for the evening of May 31st with the potential for additional showings.

Website: https://docs.google.com/forms/d/e/1FAIpQLSdw67oMXmYGOM5zfDTk1pfhBtSAiQMC2idOc7LJ32G4BtbO4A/viewform

Intrepid Sea, Air & Space Museum

Pier 86, W 46th St

New York

NY 10036

4/1/2024 First Responders Gathering

Cost: Free

Gathering: First Responders

Our First Line peer gathering is for Law Enforcement, Fire & Rescue, EMS, Dispatchers, Corrections, and Federal Agents.

Our in-person gatherings are led by Pastor Andrew Columbia, who served as an NYC Police Officer, served as part of the Ground Zero Clergy Task Force during & after 9/11, now serves as the Lead Pastor of MCB Church in Carmel, and is a Chaplain with the Putnam County Sheriff’s Department & Kent Police Department in Carmel.

These gatherings are an open forum and offer an opportunity to listen, learn, and share what’s on your mind.

WHEN: Monday, April 1 @ 7 – 8:30 pm ET

WHERE: Mt. Carmel Baptist Church, Carmel, NY

RSVP

Website: https://www.guardianrevival.org/calendar/gatherings-2024-04-01-first-line

Mt. Carmel Baptist Church

76 Gleneida Avenue

Carmel Hamlet

NY 10512

Tuesday

Apr 02

4/1/2024 – 5/31/2024 Exit12 Participants for its Next Project in April and May

Cost: Free

*Please note 15-20 participants will be invited to join the project. Fill out the interest form asap*

Following last year’s Truths Colliding workshops, Exit12 and the Intrepid Museum are bringing together a group of veterans, military-connected individuals, and civilians for a series of movement workshops. Over six weeks, Exit12 will hold space for participants to share stories about their service. By sharing these stories we aim to build cross-cultural dialogue, empathy, and healing.

We are looking for military members, veterans, and their family members in the NYC metro area to join us for this project. Participants will receive a stipend and travel reimbursement for the workshop series and performance.

Please register your interest via this link

bit.ly/E12SoW_InterestForm

Workshops will be held at the Intrepid from 6:30pm – 8:30pm on the following dates:

April 22nd

April 29th

May 6th

May 13th

May 20th

Wednesday, May 29th or Thursday, May 30th (TBC)

The performance is scheduled for the evening of May 31st with the potential for additional showings.

Website: https://docs.google.com/forms/d/e/1FAIpQLSdw67oMXmYGOM5zfDTk1pfhBtSAiQMC2idOc7LJ32G4BtbO4A/viewform

Intrepid Sea, Air & Space Museum

Pier 86, W 46th St

New York

NY 10036

4/2/2024 REMOTE WORK OPTIONS | For Military Spouses!

Cost: Free

*Please note that times listed below are Pacific Time*

When: April 2, 2024 1:00 PM – 2:30 PM ET

Associated with Program | Blue Star Careers Community

Identify Vetted REMOTE WORK OPTIONS for Military Spouses. Receive valuable tips on how and where to locate VETTED remote work opportunities. Who are our Military Spouse-Friendly Employers with Remote careers? Evaluate your skills and learn how to stand out in this competitive market. This monthly workshop is on remote work options ONLY. Attendees will be shared with some job leads with remote work options and given the option to apply!

Every second Tuesday of the Month, 10:00 AM PT / 1 PM ET via Zoom. We have limited seats available to support post-event follow-up.

Website: https://neighborhood.bluestarfam.org/events/80481

Virtual

Zoom

4/2/2024 Jams: Beacon

Cost: Free

Weekly Beacon Jam Sessions

Our Jam sessions are outlets for guardians to explore & enjoy music and build meaningful relationships.

Hosted by a trained Lead Musician, Jams are designed for community-based music experiences.

Guardians of any skill level are welcome to join — using your own instrument or one of ours.

WHO: Guardians only (veterans & first responders)

We welcome all guardians (active & retired): Veterans, Active Military, Reserve, National Guard, Law Enforcement, Fire & Rescue, EMS, Dispatchers, Corrections, and Federal Agents

WHEN: Tuesdays @ 6 – 8 PM ET

WHERE: Guardian Revival HQ, Veterans Memorial Building

413 Main St, Beacon, NY 12508

Downstairs hall / stage

RSVP

Website: https://www.guardianrevival.org/calendar/2024-04-02-jams-beacon

Guardian Revival HQ – Veterans Memorial Building

413 Main St

Downstairs hall / stage

Beacon

NY 12508

Wednesday

Apr 03

4/1/2024 – 5/31/2024 Exit12 Participants for its Next Project in April and May

Cost: Free

*Please note 15-20 participants will be invited to join the project. Fill out the interest form asap*

Following last year’s Truths Colliding workshops, Exit12 and the Intrepid Museum are bringing together a group of veterans, military-connected individuals, and civilians for a series of movement workshops. Over six weeks, Exit12 will hold space for participants to share stories about their service. By sharing these stories we aim to build cross-cultural dialogue, empathy, and healing.

We are looking for military members, veterans, and their family members in the NYC metro area to join us for this project. Participants will receive a stipend and travel reimbursement for the workshop series and performance.

Please register your interest via this link

bit.ly/E12SoW_InterestForm

Workshops will be held at the Intrepid from 6:30pm – 8:30pm on the following dates:

April 22nd

April 29th

May 6th

May 13th

May 20th

Wednesday, May 29th or Thursday, May 30th (TBC)

The performance is scheduled for the evening of May 31st with the potential for additional showings.

Website: https://docs.google.com/forms/d/e/1FAIpQLSdw67oMXmYGOM5zfDTk1pfhBtSAiQMC2idOc7LJ32G4BtbO4A/viewform

Intrepid Sea, Air & Space Museum

Pier 86, W 46th St

New York

NY 10036

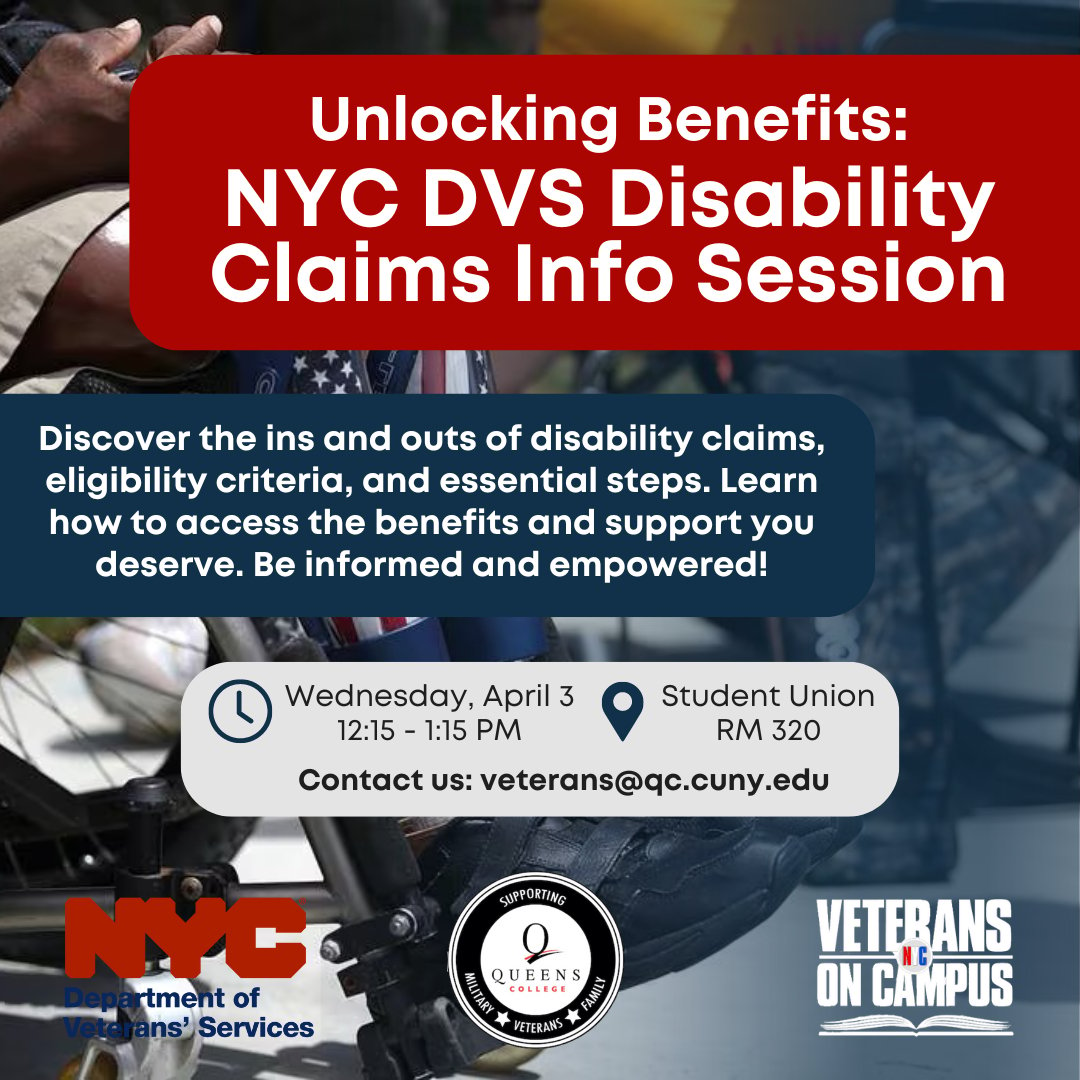

4/3/2024 Unlocking Benefits: NYC DVS Disability Claims Info Session

Cost: Free

Queens College

65-30 Kissena Blvd

Flushing

NY 11367

4/3/2024 Gathering: Wellness Wednesdays

Cost: Free

Gathering: Wellness Wednesdays

This peer gathering is open to all guardians — Veterans, Active Military, Reserve & National Guard, Law Enforcement, Fire & Rescue, EMS, Dispatchers, Corrections, and Federal Agents.

Join us for Wellness Wednesdays! This gathering will focus on various topics related to health & wellness, including exercise, nutrition, mindfulness, and sleep.

Hosted by Monty and Kenny, former Navy SEALs and Peer Leaders from Guardian Revival, these gatherings are an open forum and offer an opportunity to listen, learn, and share what’s on your mind.

WHO: Guardians only

WHEN: Wednesdays @ 5 – 6 PM ET

WHERE: Zoom

RSVP

Website: https://www.guardianrevival.org/calendar/gathering-2024-04-03-wellness

Virtual

Zoom

Thursday

Apr 04

4/1/2024 – 5/31/2024 Exit12 Participants for its Next Project in April and May

Cost: Free

*Please note 15-20 participants will be invited to join the project. Fill out the interest form asap*

Following last year’s Truths Colliding workshops, Exit12 and the Intrepid Museum are bringing together a group of veterans, military-connected individuals, and civilians for a series of movement workshops. Over six weeks, Exit12 will hold space for participants to share stories about their service. By sharing these stories we aim to build cross-cultural dialogue, empathy, and healing.

We are looking for military members, veterans, and their family members in the NYC metro area to join us for this project. Participants will receive a stipend and travel reimbursement for the workshop series and performance.

Please register your interest via this link

bit.ly/E12SoW_InterestForm

Workshops will be held at the Intrepid from 6:30pm – 8:30pm on the following dates:

April 22nd

April 29th

May 6th

May 13th

May 20th

Wednesday, May 29th or Thursday, May 30th (TBC)

The performance is scheduled for the evening of May 31st with the potential for additional showings.

Website: https://docs.google.com/forms/d/e/1FAIpQLSdw67oMXmYGOM5zfDTk1pfhBtSAiQMC2idOc7LJ32G4BtbO4A/viewform

Intrepid Sea, Air & Space Museum

Pier 86, W 46th St

New York

NY 10036

4/10/2024 HelloFresh (registration open until 4/4)

Cost: Free

*Please note registration is open until 4/4*

When: April 10, 2024 1:30 PM – 3:30 PM ET

Associated with Chapter | Craig Newmark New York Tri-State

HelloFresh Sign-Up: 4/10/24

A special thank you to the NYC Department of Veterans’ Service and HelloFresh! All levels of members, regardless of rank, can receive HelloFresh meal kits.

Sign Up: Registration is open until 4/4/24.

Distribution Details: HelloFresh will be distributed on the 2nd and 4th Wednesdays of each month, aligning with the Essential Market schedule.

Reminder Notifications: You will receive a reminder email about your sign-up two days. Please add this to your calendar after you register.

Pick-up: Pick-up will be at the Deck House/Family Meeting Center between 1:30 PM – 3:30 PM (May be delayed)

Additional Info: Each meal feeds two, so based on your family size, please take that into account when you are determining how many kits you will need. As a reminder, due to supply issues, vegetarian and chicken meals will be evenly distributed to the amount you request.

If you are unable to pick up during that time, please coordinate with a family member or friend to pick up on your behalf. Please contact Consuela at 904-309-1817 to let them know if you are unable to pick up so we can redistribute.

Volunteer Opportunity: If you’re interested in volunteering for distribution, please reach out to Consuela at [email protected].

Website: https://neighborhood.bluestarfam.org/events/81174

Fort Wadsworth

456 Tennessee Rd

2nd Floor of Family Meeting Center

Staten Island

NY 10305

4/24/2024 HelloFresh (registration open until 4/18)

Cost: Free

*Please note registration is open until 4/18*

When: April 24, 2024 1:30 PM – 3:30 PM ET

Associated with Chapter | Craig Newmark New York Tri-State

HelloFresh Sign-Up: 4/24/24

A special thank you to the NYC Department of Veterans’ Service and HelloFresh! All levels of members, regardless of rank, can receive HelloFresh meal kits.

Sign Up: Registration is open until 4/18/24.

Distribution Details: HelloFresh will be distributed on the 2nd and 4th Wednesdays of each month, aligning with the Essential Market schedule.

Reminder Notifications: You will receive a reminder email about your sign-up two days. Please add this to your calendar after you register.

Pick-up: Pick-up will be at the Deck House/Family Meeting Center between 1:30 PM – 3:30 PM (May be delayed)

Additional Info: Each meal feeds two, so based on your family size, please take that into account when you are determining how many kits you will need. As a reminder, due to supply issues, vegetarian and chicken meals will be evenly distributed to the amount you request.

If you are unable to pick up during that time, please coordinate with a family member or friend to pick up on your behalf. Please contact Consuela at 904-309-1817 to let them know if you are unable to pick up so we can redistribute.

Volunteer Opportunity: If you’re interested in volunteering for distribution, please reach out to Consuela at [email protected].

Website: https://neighborhood.bluestarfam.org/events/81265

Fort Wadsworth

456 Tennessee Rd

2nd Floor of Family Meeting Center

Staten Island

NY 10305

4/4/2024 Veteran Empowerment Workshop

Cost: Free

More than a peer support group!

Better than a writing workshop!

Discover the Power of an Empowerment Workshop!

WVE&T facilitates workshops to practice skills in every day life !

~Learn to empower yourself from within your experiences, don’t let them hold you down.

~Build yourself up, learn to Thrive instead of just surviving each day

~Reconnect with family/loved ones by applying skills from workshop into relationships

~Schedule time for yourself without apologies

~Practice observing your inner thoughts without judgment

Give it a try!

Free, Ongoing, Virtual

Previous artistic/writing experience not necessary.

Website: https://www.womenveteransempowered.org/event-info/all-veterans-empowerment-workshop-2024-04-04-18-30

Virtual

Zoom

Friday

Apr 05

4/1/2024 – 5/31/2024 Exit12 Participants for its Next Project in April and May

Cost: Free

*Please note 15-20 participants will be invited to join the project. Fill out the interest form asap*

Following last year’s Truths Colliding workshops, Exit12 and the Intrepid Museum are bringing together a group of veterans, military-connected individuals, and civilians for a series of movement workshops. Over six weeks, Exit12 will hold space for participants to share stories about their service. By sharing these stories we aim to build cross-cultural dialogue, empathy, and healing.

We are looking for military members, veterans, and their family members in the NYC metro area to join us for this project. Participants will receive a stipend and travel reimbursement for the workshop series and performance.

Please register your interest via this link

bit.ly/E12SoW_InterestForm

Workshops will be held at the Intrepid from 6:30pm – 8:30pm on the following dates:

April 22nd

April 29th

May 6th

May 13th

May 20th

Wednesday, May 29th or Thursday, May 30th (TBC)

The performance is scheduled for the evening of May 31st with the potential for additional showings.

Website: https://docs.google.com/forms/d/e/1FAIpQLSdw67oMXmYGOM5zfDTk1pfhBtSAiQMC2idOc7LJ32G4BtbO4A/viewform

Intrepid Sea, Air & Space Museum

Pier 86, W 46th St

New York

NY 10036

4/5/2024 Vet2Vet Peer Gathering

Cost: Free

Gathering: Veterans

Our Vet2Vet peer gathering is open to all Veterans, Active Military, Reserve & National Guard.

Led by a Peer Leader veteran from Guardian Revival, these gatherings are an open forum and offer an opportunity to listen, learn, and share what’s on your mind.

WHO: Guardians only

WHEN: Fridays @ 6 – 7 pm ET

WHERE: Zoom

RSVP

Website: https://www.guardianrevival.org/calendar/gathering-2024-04-05-veterans

Virtual

Zoom

Saturday

Apr 06

4/1/2024 – 5/31/2024 Exit12 Participants for its Next Project in April and May

Cost: Free

*Please note 15-20 participants will be invited to join the project. Fill out the interest form asap*

Following last year’s Truths Colliding workshops, Exit12 and the Intrepid Museum are bringing together a group of veterans, military-connected individuals, and civilians for a series of movement workshops. Over six weeks, Exit12 will hold space for participants to share stories about their service. By sharing these stories we aim to build cross-cultural dialogue, empathy, and healing.

We are looking for military members, veterans, and their family members in the NYC metro area to join us for this project. Participants will receive a stipend and travel reimbursement for the workshop series and performance.

Please register your interest via this link

bit.ly/E12SoW_InterestForm

Workshops will be held at the Intrepid from 6:30pm – 8:30pm on the following dates:

April 22nd

April 29th

May 6th

May 13th

May 20th

Wednesday, May 29th or Thursday, May 30th (TBC)

The performance is scheduled for the evening of May 31st with the potential for additional showings.

Website: https://docs.google.com/forms/d/e/1FAIpQLSdw67oMXmYGOM5zfDTk1pfhBtSAiQMC2idOc7LJ32G4BtbO4A/viewform

Intrepid Sea, Air & Space Museum

Pier 86, W 46th St

New York

NY 10036

4/6/2024 Women Guardians Outing | April

Cost: Free

Another Summit hosts outings designed by women guardians, for women guardians, on the 1st Saturday of each month.

For our April Women Guardians Outing you can join our outdoor leaders, Elena and Dawn, on a wildflower-spotting walk at the Stony Kill Environmental Education Center in Fishkill. On this walk, we’ll keep an eye out for some of the native ephemeral wildflowers of New York, such as bloodroot and trillium. Often found blooming from early March to late May — depending on the weather — these gorgeous early-spring blooms only last for a short time, so lets see how many we can spot! We’ll also pause for a picnic lunch by the scenic pasture on Verplanck Ridge.

Website: https://www.guardianrevival.org/calendar/2024-04-06-women-guardians-outing

Verplanck Ridge Trailhead

21-79 Farmstead Lane

Wappingers Falls

New York 12590

4/6/2024 Bay 84th Street Garden Build and Mulch

Cost: Free

When: April 6, 2024 from 10:00am – 2:00 pm

Associated with NEW YORK CITY PLATOON

TMC is heading back to Bay 84th community garden to continue the good work. This is an event that had to be postponed due to weather and planning by the NYC platoons. Tasks include the following:

-Build an archway and other items

-Move a compost bin to a more accessible location

-Move a mound of soil to the garden beds and distribute mulch

-Weed whack

-Install non-toxic mosquito traps

We look forward to seeing you there!

Website: https://www.missioncontinues.org/event/details/a1l8Z00000BarE7QAJ/

Bay 84th Street

3-22 Beach 84th St

Far Rockaway

NY

Sunday

Apr 07

4/1/2024 – 5/31/2024 Exit12 Participants for its Next Project in April and May

Cost: Free

*Please note 15-20 participants will be invited to join the project. Fill out the interest form asap*

Following last year’s Truths Colliding workshops, Exit12 and the Intrepid Museum are bringing together a group of veterans, military-connected individuals, and civilians for a series of movement workshops. Over six weeks, Exit12 will hold space for participants to share stories about their service. By sharing these stories we aim to build cross-cultural dialogue, empathy, and healing.

We are looking for military members, veterans, and their family members in the NYC metro area to join us for this project. Participants will receive a stipend and travel reimbursement for the workshop series and performance.

Please register your interest via this link

bit.ly/E12SoW_InterestForm

Workshops will be held at the Intrepid from 6:30pm – 8:30pm on the following dates:

April 22nd

April 29th

May 6th

May 13th

May 20th

Wednesday, May 29th or Thursday, May 30th (TBC)

The performance is scheduled for the evening of May 31st with the potential for additional showings.

Website: https://docs.google.com/forms/d/e/1FAIpQLSdw67oMXmYGOM5zfDTk1pfhBtSAiQMC2idOc7LJ32G4BtbO4A/viewform

Intrepid Sea, Air & Space Museum

Pier 86, W 46th St

New York

NY 10036

4/7/2024 Veterans Paintball Battle

Cost: Free

*Please note that Pathfinder and the BWF do not have any other information about this event than what is listed here. Call or email the point of contact listed above (Mike) for time and location details, and to RSVP*

4/7/2024 Area Beautification at La Finca Del Sur

Cost: Free

When: April 7, 2024 from 10:00am – 2:00 pm

Associated with: NEW YORK CITY PLATOON

The Name: “La Finca del Sur” translates from Spanish as “Farm of the South”. The name was chosen to reflect the Latina/o heritage of many of their farmers. With that being said, Join us at La Finca Del Sur this Spring to complete the following tasks below and do some networking while we’re there. 1. Prune Branches & Trees 2. Repair 2 or more 12ft length boards of garden beds in the back of the garden 3. Replace 2 garden beds 4. Dig 2 poles into the ground (about 7 feet apart) behind the back of the garden to host banner in remembrance of garden member. Optional Tasks (if enough people come out) 1. Replace greenhouse door – the hinges are functional. the door itself is beat up 2. Build compost bins How to get there By Car – The address is 110 E 138th St, Bronx, NY 10451 By Bus – Take the Bx33 or Bx1 to 138th Street and Grand Concourse By Train – Take the 4 or 5 trains to 138th Street – Grand Concourse

Website: https://www.missioncontinues.org/event/details/a1lWP000000IBQ1YAO/

La Finca Del Sur

110 E 138th St

Bronx

NY 10451

4/7/2024 Women Veterans Empowerment Workshop

Cost: Free

Are you exhausted? Is your energy depleted?

Don’t add another thing to your “to do” list!

Join us and learn how to invest your time into replenishment and recuperation!

Be a part of a community that supports through the struggles and thrives together!

Discover Empowerment within YOU!

WVE&T facilitates workshops to practice skills of Empowerment

~Schedule time for yourself without apologizes

~Learn to empower yourself from within your experiences

~Practice observing your thoughts without judgment

~Reintegrate from selfless service to self compassion.

Free, Ongoing, Virtual

RSVP: www.womenveteransempowered.org

Website: https://www.womenveteransempowered.org/event-info/women-veterans-empowerment-workshop-2024-04-07-13-00

Virtual

Zoom

4/7/2024 Women Veterans Empowerment Workshop

Cost: Free

Are you exhausted? Is your energy depleted?

Don’t add another thing to your “to do” list!

Join us and learn how to invest your time into replenishment and recuperation!

Be a part of a community that supports through the struggles and thrives together!

Discover Empowerment within YOU!

WVE&T facilitates workshops to practice skills of Empowerment

~Schedule time for yourself without apologizes

~Learn to empower yourself from within your experiences

~Practice observing your thoughts without judgment

~Reintegrate from selfless service to self compassion.

Free, Ongoing, Virtual

Website: https://www.womenveteransempowered.org/event-info/women-veterans-empowerment-workshop-2024-04-07-13-00

Virtual

Zoom

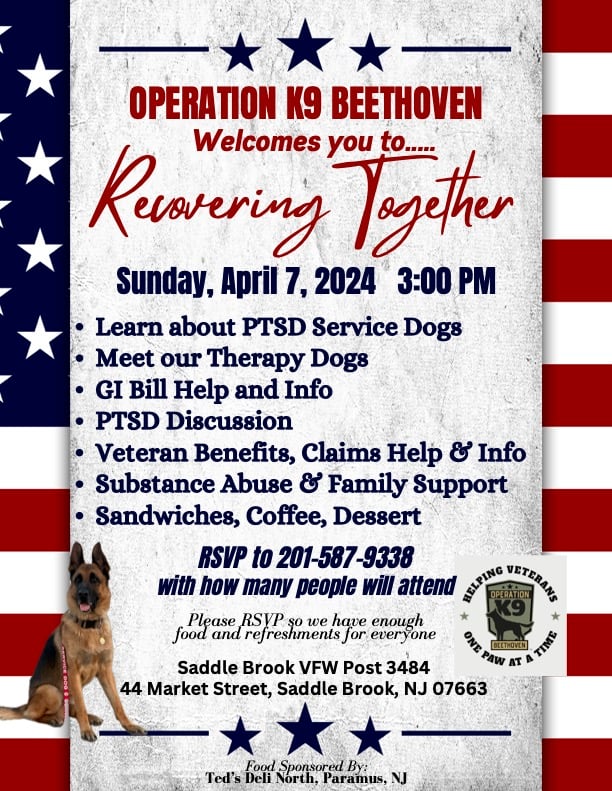

4/7/2024 Operation K9 Beethoven – Recovering Together

Cost: Free

Operation K9 Beethoven – Recovering Together

- Learn about PTSD Service Dogs

- Meet our Therapy Dogs (Beethoven, Duffy (deaf therapy dog), Luna, Sophie, Blaze, Chase, Zola).

- GI Bill Discussion

- PTSD Discussion

- Veteran Benefits / Claims Help and Information

- Substance Abuse and Family Support

- Sandwiches, Coffee, Dessert

Please RSVP to 201-587-9338 with how many people will attend, so we have enough food and refreshments for everyone.

TOPICS / SPEAKERS:

- PSYCHIATRIC SERVICE DOGS – Brian Reyngoudt, VP, Operation K9 Beethoven and Member of VFW 3484, Saddle Brook, NJ

- GI BILL – Sgt. Angel Gutierrez, Veterans Employment Counselor, State of New Jersey

- VETERANS BENEFITS AND CLAIMS – Ryan Mahara, Veteran Service Officer, Dept. of NJ VFW and Dept. of Veterans Affairs

- SUBSTANCE ABUSE AND FAMILY SUPPORT – John S., Member of American Legion Sons, Post 57, Walwick, NJ

There will be a representative(s) from the following organizations in attendance:

- LCPL Jedh C. Barker Detachment, Marine Corps League

- New Jersey Veterans Network

- Dept. of NJ Veterans of Foreign Wars

Food sponsored by Ted’s North, Paramus, NJ

TOPICS / SPEAKERS:

PSYCHIATRIC SERVICE DOGS – Brian Reyngoudt, VP, Operation K9 Beethoven and Member of VFW 3484, Saddle Brook, NJ

GI BILL – Sgt. Angel Gutierrez, Veterans Employment Counselor, State of New Jersey

PTSD – Dennis Adesso, President/Co-Founder MA22

VETERANS BENEFITS AND CLAIMS – Ryan Mahara, Veteran Service Officer, Dept. of NJ VFW and Dept. of Veterans Affairs

SUBSTANCE ABUSE AND FAMILY SUPPORT – John S., Member of American Legion Sons, Post 57, Walwick, NJ

Saddle Brook VFW Post 3484

44 Market Street

Saddle Brook

NJ 07663

Monday

Apr 08

4/1/2024 – 5/31/2024 Exit12 Participants for its Next Project in April and May

Cost: Free

*Please note 15-20 participants will be invited to join the project. Fill out the interest form asap*

Following last year’s Truths Colliding workshops, Exit12 and the Intrepid Museum are bringing together a group of veterans, military-connected individuals, and civilians for a series of movement workshops. Over six weeks, Exit12 will hold space for participants to share stories about their service. By sharing these stories we aim to build cross-cultural dialogue, empathy, and healing.

We are looking for military members, veterans, and their family members in the NYC metro area to join us for this project. Participants will receive a stipend and travel reimbursement for the workshop series and performance.

Please register your interest via this link

bit.ly/E12SoW_InterestForm

Workshops will be held at the Intrepid from 6:30pm – 8:30pm on the following dates:

April 22nd

April 29th

May 6th

May 13th

May 20th

Wednesday, May 29th or Thursday, May 30th (TBC)

The performance is scheduled for the evening of May 31st with the potential for additional showings.

Website: https://docs.google.com/forms/d/e/1FAIpQLSdw67oMXmYGOM5zfDTk1pfhBtSAiQMC2idOc7LJ32G4BtbO4A/viewform

Intrepid Sea, Air & Space Museum

Pier 86, W 46th St

New York

NY 10036

4/8/2024 First Responders Gathering

Cost: Free

Gathering: First Responders

Our First Line peer gathering is open to all Law Enforcement, Fire & Rescue, EMS, Dispatchers, Corrections, and Federal Agents to network & connect with peers.

Led by a Peer Leader first responder from Guardian Revival, these gatherings are an open forum and offer an opportunity to learn, listen, or share what’s on your mind.

WHEN: Mon, April 8 @ 7 – 8 pm ET

WHERE: Zoom

RSVP

Website: https://www.guardianrevival.org/calendar/gatherings-2024-04-08-first-line

Virtual

Zoom

4/8/2024 iRest Meditation

Cost: Free

iRest Meditation

iRest is a deep meditation practice used worldwide for its positive impact on the mind and body. This practice relieves stress and pain, improves sleep, and helps reset your nervous system.

Developed by clinical psychologist Dr. Richard Miller as a meditation technique to help soldiers, veterans, and survivors of natural disasters, Integrative Restoration (later shortened to iRest) was designed to “help us to integrate emotions, thoughts, and psychology, as well as restore us to our true wellness as human beings.” (Learn more about iRest on our blog.)

Used in military and first responder settings as a top-tier approach to mental health & wellness, iRest is rapidly growing in popularity in our guardian communities. In the words of one of our GR Peer Leaders who is a trauma therapist & social worker and has worked in Law Enforcement & Fire:

“iRest is extremely helpful to relax & very beneficial as a healthy new habit. It’s worth setting aside the time — stop procrastinating & show up. This is one thing you shouldn’t wait to try.”

We hope you’ll join our next iRest Meditation with Annie:

WHEN: Monday, April 8 @ 7:30 pm ET

WHERE: Zoom

Note:

Participate with your camera on or off

Be comfortable — seated in a chair, laying in bed, or on the floor

Have a pillow & blanket available

No prior experience with mindfulness or meditation necessary!

RSVP

Website: https://www.guardianrevival.org/calendar/2024-04-08-irest

Virtual

Tuesday

Apr 09

4/1/2024 – 5/31/2024 Exit12 Participants for its Next Project in April and May

Cost: Free

*Please note 15-20 participants will be invited to join the project. Fill out the interest form asap*

Following last year’s Truths Colliding workshops, Exit12 and the Intrepid Museum are bringing together a group of veterans, military-connected individuals, and civilians for a series of movement workshops. Over six weeks, Exit12 will hold space for participants to share stories about their service. By sharing these stories we aim to build cross-cultural dialogue, empathy, and healing.

We are looking for military members, veterans, and their family members in the NYC metro area to join us for this project. Participants will receive a stipend and travel reimbursement for the workshop series and performance.

Please register your interest via this link

bit.ly/E12SoW_InterestForm

Workshops will be held at the Intrepid from 6:30pm – 8:30pm on the following dates:

April 22nd

April 29th

May 6th

May 13th

May 20th

Wednesday, May 29th or Thursday, May 30th (TBC)

The performance is scheduled for the evening of May 31st with the potential for additional showings.

Website: https://docs.google.com/forms/d/e/1FAIpQLSdw67oMXmYGOM5zfDTk1pfhBtSAiQMC2idOc7LJ32G4BtbO4A/viewform

Intrepid Sea, Air & Space Museum

Pier 86, W 46th St

New York

NY 10036

4/9/2024 Resume 101 | Strategies To Optimize Your Job Search!

Cost: Free

When: April 9, 2024 from 01:00 PM – 02:00 PM EDT

Associated with BLUE STAR CAREERS

TO REGISTER: Please add your name by responding to: “Are You Attending?”. Select YES to secure your seat.

WORKSHOP: Did you know that up to 75% of qualified job applicants have been rejected because the ATS software couldn’t read their resumes?

Your resume is essential to feature the overall career progression for the job you are applying for. An efficient resume overview, when appropriately tailored, should have an outline that is clear and direct and shows your qualifications.

The resume is just one of the tools that can land you an interview or a job referral, and that’s our goal in this session, help you understand how to show your career trajectory in the most up to date format, yet understand working with ATS tools.

**In this interactive meeting, we will tackle best practices and show you how to update your resume efficiently to maximize your application process using various tools; doing it organic, traditional tailoring options and ChatGPT tools to supplement your resume optimization. Every 2nd Tuesday of the month; 10 AM Pacific Time

Can’t make it? join us next month or check out our Blue Star Careers media center where you can get DIY kits. Need in person support? Get support from HHUSA or MySECO. This is not recorded.

LOCATION

VIRTUAL – ZOOM|COMING SOON!

Website: https://neighborhood.bluestarfam.org/events/82132

Virtual

Zoom

4/9/2024 Jams: Beacon

Cost: Free

Weekly Beacon Jam Sessions

Our Jam sessions are outlets for guardians to explore & enjoy music and build meaningful relationships.

Hosted by a trained Lead Musician, Jams are designed for community-based music experiences.

Guardians of any skill level are welcome to join — using your own instrument or one of ours.

WHO: Guardians only (veterans & first responders)

We welcome all guardians (active & retired): Veterans, Active Military, Reserve, National Guard, Law Enforcement, Fire & Rescue, EMS, Dispatchers, Corrections, and Federal Agents

WHEN: Tuesdays @ 6 – 8 PM ET

WHERE: Guardian Revival HQ, Veterans Memorial Building

413 Main St, Beacon, NY 12508

Downstairs hall / stage

RSVP

Website: https://www.guardianrevival.org/calendar/2024-04-09-jams-beacon

Guardian Revival HQ – Veterans Memorial Building

413 Main St

Downstairs hall / stage

Beacon

NY 12508

4/9/2024 Civilian Support Members of Veterans -Empowerment Workshop

Cost: Free

Discover Empowerment within YOU!

The focus of this workshop is for civilians that support/caretake/love a veteran/reserves/active duty/national guard this workshop is for you!

Everyone has a story.

Triumphs and Struggles of every day life.

Join us to tell your story

Discover Empowerment within YOU!

Practice skills of Empowerment

~Schedule time for yourself without apologizes

~Practice speaking, writing and living authentically

~Learn to empower yourself from within your experiences

~Practice observing without judgment your inner dialogue

~Invest in a compassionate, cooperative community of

Empowerment for YOU!

Free, Ongoing, Virtual

Previous artistic/writing experience not necessary.

Website: https://www.womenveteransempowered.org/event-info/support-members-of-veterans-empowerment-workshop-2024-04-09-19-00

Virtual

Zoom

4/9/2024 Mobility for Health

Cost: Free

Mobility for Health Workshop

Semper Stronger cofounders Joel Del Rosario (a Marine) and Rebecca Rouse along with their coaches Samantha and Angela, are passionate about empowering guardians to build physical & mental strength so that you can overcome life’s challenges with confidence.

Mobility is about movement — specifically making sure your joints can easily move with you throughout your daily life. Think: getting up in the morning, taking a flight of stairs, picking things up off the floor — and doing it without pain or difficulty.

According to Harvard Medical School:

Mobility is the foundation for living a healthy and independent life. Mobility comprises all the skills required for everyday living: physical stamina, strength, balance, coordination, and range of motion… [it] also helps us avoid falls and prevent injuries, and allows older adults to live longer on their own. In short, mobility helps you stay “in the game.”

During this session, you will hear information about mobility & movement, the benefits, learn & try a few joint mobilizations, and receive advice on how to incorporate movement into daily life.

Get active, get moving, get healthy!

All G-Connect experiences are free but RSVP is required:

WHEN: Tuesday, April 9 @ 7:00 – 8:00 PM ET

WHERE: Zoom

Modifications are given if needed

RSVP

Website: https://www.guardianrevival.org/calendar/2024-04-09-mobility-for-health

Virtual

Zoom

Wednesday

Apr 10

4/1/2024 – 5/31/2024 Exit12 Participants for its Next Project in April and May

Cost: Free

*Please note 15-20 participants will be invited to join the project. Fill out the interest form asap*

Following last year’s Truths Colliding workshops, Exit12 and the Intrepid Museum are bringing together a group of veterans, military-connected individuals, and civilians for a series of movement workshops. Over six weeks, Exit12 will hold space for participants to share stories about their service. By sharing these stories we aim to build cross-cultural dialogue, empathy, and healing.

We are looking for military members, veterans, and their family members in the NYC metro area to join us for this project. Participants will receive a stipend and travel reimbursement for the workshop series and performance.

Please register your interest via this link

bit.ly/E12SoW_InterestForm

Workshops will be held at the Intrepid from 6:30pm – 8:30pm on the following dates:

April 22nd

April 29th

May 6th

May 13th

May 20th

Wednesday, May 29th or Thursday, May 30th (TBC)

The performance is scheduled for the evening of May 31st with the potential for additional showings.

Website: https://docs.google.com/forms/d/e/1FAIpQLSdw67oMXmYGOM5zfDTk1pfhBtSAiQMC2idOc7LJ32G4BtbO4A/viewform

Intrepid Sea, Air & Space Museum

Pier 86, W 46th St

New York

NY 10036

4/10/2024 Nourish the Service Essentials Market on Fort Wadsworth

Cost: Free

When: April 10, 2024 9:00 AM – 5:00 PM ET

Associated with Chapter | Craig Newmark New York Tri-State

Nourish the Service Essentials Market on Fort Wadsworth

All military & veteran families are welcome to shop at the market, regardless of rank, family size, or veteran status. Just make sure to bring your ID for entry.

WHEN: April 10th, 9:00 AM – 5:00 PM

WHERE: 2nd Floor, Family Meeting Center – Fort Wadsworth, 455 USS Tennessee Rd, Staten Island, NY 10305

Please bring your reusable bag. Kindly note that, prioritizing your safety and shopping experience, a maximum number of individuals will be allowed in the market at the same time. Thank you!

Website: https://neighborhood.bluestarfam.org/events/81267

Fort Wadsworth

456 Tennessee Rd

2nd Floor of Family Meeting Center

Staten Island

NY 10305

4/10/2024 Gathering: Wellness Wednesdays

Cost: Free

Gathering: Wellness Wednesdays

This peer gathering is open to all guardians — Veterans, Active Military, Reserve & National Guard, Law Enforcement, Fire & Rescue, EMS, Dispatchers, Corrections, and Federal Agents.

Join us for Wellness Wednesdays! This gathering will focus on various topics related to health & wellness, including exercise, nutrition, mindfulness, and sleep.

Hosted by Monty and Kenny, former Navy SEALs and Peer Leaders from Guardian Revival, these gatherings are an open forum and offer an opportunity to listen, learn, and share what’s on your mind.

WHO: Guardians only

WHEN: Wednesdays @ 5 – 6 PM ET

WHERE: Zoom

RSVP

Website: https://www.guardianrevival.org/calendar/gathering-2024-04-10-wellness

Virtual

Zoom

Thursday

Apr 11

4/1/2024 – 5/31/2024 Exit12 Participants for its Next Project in April and May

Cost: Free

*Please note 15-20 participants will be invited to join the project. Fill out the interest form asap*

Following last year’s Truths Colliding workshops, Exit12 and the Intrepid Museum are bringing together a group of veterans, military-connected individuals, and civilians for a series of movement workshops. Over six weeks, Exit12 will hold space for participants to share stories about their service. By sharing these stories we aim to build cross-cultural dialogue, empathy, and healing.

We are looking for military members, veterans, and their family members in the NYC metro area to join us for this project. Participants will receive a stipend and travel reimbursement for the workshop series and performance.

Please register your interest via this link

bit.ly/E12SoW_InterestForm

Workshops will be held at the Intrepid from 6:30pm – 8:30pm on the following dates:

April 22nd

April 29th

May 6th

May 13th

May 20th

Wednesday, May 29th or Thursday, May 30th (TBC)

The performance is scheduled for the evening of May 31st with the potential for additional showings.

Website: https://docs.google.com/forms/d/e/1FAIpQLSdw67oMXmYGOM5zfDTk1pfhBtSAiQMC2idOc7LJ32G4BtbO4A/viewform

Intrepid Sea, Air & Space Museum

Pier 86, W 46th St

New York

NY 10036

4/11/2024 Brooklyn Starbucks Coffee Connect

Cost: Free

When: April 11, 2024 3:00 PM – 5:00 PM UTC

Join Blue Star Families and Starbucks for another fun-filled Coffee Connect on 4/11/24. Whether you’re new to the community or you’ve been here a while, let’s connect over a cup of coffee!

Families are encouraged to join us, and FREE refreshments will be available for all attendees. We’ll have fun crafts and delightful treats to enjoy!

Website: https://neighborhood.bluestarfam.org/events/80407

Starbucks Brooklyn

9202 Third Ave

Brooklyn

NY 11209

4/11/2024 American Military History Series

Cost: Free

American Military History Series

Join our monthly American Military History series with hosts Richie Othmer & John MacEnroe. Come learn more about the Hudson Valley region & its military history.

WHO: Open to the public — feel free to bring a friend or family member

WHEN: Thursday, April 11 @ 7 PM ET

WHERE: In-Person @ 413 Main Street, Beacon, NY 12508

RSVP

Website: https://www.guardianrevival.org/calendar/2023-04-11-american-history

Beacon VMB (GR HQ)

413 Main Street

Beacon

NY 12508

Friday

Apr 12

4/1/2024 – 5/31/2024 Exit12 Participants for its Next Project in April and May

Cost: Free

*Please note 15-20 participants will be invited to join the project. Fill out the interest form asap*

Following last year’s Truths Colliding workshops, Exit12 and the Intrepid Museum are bringing together a group of veterans, military-connected individuals, and civilians for a series of movement workshops. Over six weeks, Exit12 will hold space for participants to share stories about their service. By sharing these stories we aim to build cross-cultural dialogue, empathy, and healing.

We are looking for military members, veterans, and their family members in the NYC metro area to join us for this project. Participants will receive a stipend and travel reimbursement for the workshop series and performance.

Please register your interest via this link

bit.ly/E12SoW_InterestForm

Workshops will be held at the Intrepid from 6:30pm – 8:30pm on the following dates:

April 22nd

April 29th

May 6th

May 13th

May 20th

Wednesday, May 29th or Thursday, May 30th (TBC)

The performance is scheduled for the evening of May 31st with the potential for additional showings.

Website: https://docs.google.com/forms/d/e/1FAIpQLSdw67oMXmYGOM5zfDTk1pfhBtSAiQMC2idOc7LJ32G4BtbO4A/viewform

Intrepid Sea, Air & Space Museum

Pier 86, W 46th St

New York

NY 10036

4/12/2024 Vet2Vet Peer Gathering

Cost: Free

Gathering: Veterans

Our Vet2Vet peer gathering is open to all Veterans, Active Military, Reserve & National Guard.

Led by a Peer Leader veteran from Guardian Revival, these gatherings are an open forum and offer an opportunity to listen, learn, and share what’s on your mind.

WHO: Guardians only

WHEN: Fridays @ 6 – 7 pm ET

WHERE: Zoom

RSVP

Website: https://www.guardianrevival.org/calendar/gathering-2024-04-19-veterans

Virtual

Zoom

Saturday

Apr 13

4/1/2024 – 5/31/2024 Exit12 Participants for its Next Project in April and May

Cost: Free

*Please note 15-20 participants will be invited to join the project. Fill out the interest form asap*

Following last year’s Truths Colliding workshops, Exit12 and the Intrepid Museum are bringing together a group of veterans, military-connected individuals, and civilians for a series of movement workshops. Over six weeks, Exit12 will hold space for participants to share stories about their service. By sharing these stories we aim to build cross-cultural dialogue, empathy, and healing.

We are looking for military members, veterans, and their family members in the NYC metro area to join us for this project. Participants will receive a stipend and travel reimbursement for the workshop series and performance.

Please register your interest via this link

bit.ly/E12SoW_InterestForm

Workshops will be held at the Intrepid from 6:30pm – 8:30pm on the following dates:

April 22nd

April 29th

May 6th

May 13th

May 20th

Wednesday, May 29th or Thursday, May 30th (TBC)

The performance is scheduled for the evening of May 31st with the potential for additional showings.

Website: https://docs.google.com/forms/d/e/1FAIpQLSdw67oMXmYGOM5zfDTk1pfhBtSAiQMC2idOc7LJ32G4BtbO4A/viewform

Intrepid Sea, Air & Space Museum

Pier 86, W 46th St

New York

NY 10036

4/13/2024 – 4/14/2024 Backpacking 101

Cost: Free

Interested in backpacking but don’t know where to start? Join Another Summit for this intro to backpacking class where you’ll learn new skills that’ll help you get even more from your time outdoors. On this two-day, one-night adventure you’ll learn:

– What to bring

– How to set up a tent

– Water purification

– Backcountry cooking

– Basic navigation

– And more!

All major gear and food is provided. Participation for this outing is by application. Don’t miss out on this opportunity to participate in a world-class outing and learn how to backpack from our outdoor experts.

Website: https://www.guardianrevival.org/calendar/2024-04-13-backpacking-101

Harriman State Park – Elk Pen Parking Lot

Elk Pen Parking Lot

Arden

New York 10910

4/13/2024 Rincon Criollo Community Garden – Greenhouse Build – Prep Day

Cost: Free

When: April 13, 2024 from 11:00 AM – 03:00 PM EDT

Associated with NEW YORK CITY PLATOON

Hello Everyone! Let’s hope by the time this event comes around, the weather is nice enough for us to hang outside for a bit. Here are the tasks we need to get done that day: 1. Allocate the dirt hill into a hole/garden bed area. 2. Remove excess bricks, stone and dirt into dumpster. 3. Remove carpet into dumpster 4. Build “U” Garden Bed How to get there: By Car – Enter Rincon Criollo ~ La Casita de Chema or 749 Brook Ave, Bronx, NY, 10451 By Train – Take the 2 or 5 trains to either Jackson Ave or 3rd Ave/149th Street. Walking to either train station takes the same amount of time. Trains may act up on the weekends, so plan accordingly. By Bus – Take the Bx15 or Bx21 bus to 3rd Ave and East 157th Street.

Website: https://www.missioncontinues.org/event/details/a1l8Z00000Baql0QAB/

Rincon Criollo Community Garden

749 Brook Avenue

Bronx

NY 10451

4/13/2024 Boots & Paws Companion Dog Awarding

Cost: Free

Boots & Paws Companion Dog Awarding

We’re awarding a golden retriever puppy to a guardian thanks to the generous support of the Helping Heroes Club.

Companion dog awardings are memorable moments where we introduce a puppy and their guardian. We hope you’ll come join us for this special event!

WHO: Open to the public

WHEN: Saturday, April 13 @ 12 PM ET

WHERE: Chappaqua Gazebo

148–164 S Greeley Ave

Chappaqua, NY 10514

Across the street from Robert E Bell Middle School

No RSVP required

Website: https://www.guardianrevival.org/calendar/2023-04-13-dog-awarding

Chappaqua Gazebo

148–164 S Greeley Ave

Chappaqua

NY 10514

4/13/2024 Companion Dog Fundraiser

Cost: $55/person

Boots & Paws German American Social Club Veteran’s Benefit Dinner

Enjoy a Bavarian Schnitzel dinner and support Boots & Paws at the same time!

The German American Club of Peekskill is hosting a Veterans Benefit Dinner and all net proceeds will go towards sponsoring a companion dog for a guardian in need.

WHEN: Saturday, April 13 @ 5 – 9 pm

WHERE: German American Club of Peekskill

11 Kramers Pond Rd, Putnam Valley, NY 10579

WHO: Open to the public.

RSVP to Herb Seeff 845-621-1872

PRE-PAID EVENT: $55 per person

Make check payable to American German Club

Mail to 12 Indian Ave, Mahopac, NY 10541

We hope to see you there!

Website: https://www.guardianrevival.org/calendar/2024-04-13-german-american-benefit-dinner

German American Club of Peekskill

11 Kramers Pond Rd

Putnam Valley

NY 10579

Sunday

Apr 14

4/1/2024 – 5/31/2024 Exit12 Participants for its Next Project in April and May

Cost: Free

*Please note 15-20 participants will be invited to join the project. Fill out the interest form asap*

Following last year’s Truths Colliding workshops, Exit12 and the Intrepid Museum are bringing together a group of veterans, military-connected individuals, and civilians for a series of movement workshops. Over six weeks, Exit12 will hold space for participants to share stories about their service. By sharing these stories we aim to build cross-cultural dialogue, empathy, and healing.

We are looking for military members, veterans, and their family members in the NYC metro area to join us for this project. Participants will receive a stipend and travel reimbursement for the workshop series and performance.

Please register your interest via this link

bit.ly/E12SoW_InterestForm

Workshops will be held at the Intrepid from 6:30pm – 8:30pm on the following dates:

April 22nd

April 29th

May 6th

May 13th

May 20th

Wednesday, May 29th or Thursday, May 30th (TBC)

The performance is scheduled for the evening of May 31st with the potential for additional showings.

Website: https://docs.google.com/forms/d/e/1FAIpQLSdw67oMXmYGOM5zfDTk1pfhBtSAiQMC2idOc7LJ32G4BtbO4A/viewform

Intrepid Sea, Air & Space Museum

Pier 86, W 46th St

New York

NY 10036

4/13/2024 – 4/14/2024 Backpacking 101

Cost: Free

Interested in backpacking but don’t know where to start? Join Another Summit for this intro to backpacking class where you’ll learn new skills that’ll help you get even more from your time outdoors. On this two-day, one-night adventure you’ll learn:

– What to bring

– How to set up a tent

– Water purification

– Backcountry cooking

– Basic navigation

– And more!

All major gear and food is provided. Participation for this outing is by application. Don’t miss out on this opportunity to participate in a world-class outing and learn how to backpack from our outdoor experts.

Website: https://www.guardianrevival.org/calendar/2024-04-13-backpacking-101

Harriman State Park – Elk Pen Parking Lot

Elk Pen Parking Lot

Arden

New York 10910

Monday

Apr 15

4/1/2024 – 5/31/2024 Exit12 Participants for its Next Project in April and May

Cost: Free

*Please note 15-20 participants will be invited to join the project. Fill out the interest form asap*

Following last year’s Truths Colliding workshops, Exit12 and the Intrepid Museum are bringing together a group of veterans, military-connected individuals, and civilians for a series of movement workshops. Over six weeks, Exit12 will hold space for participants to share stories about their service. By sharing these stories we aim to build cross-cultural dialogue, empathy, and healing.

We are looking for military members, veterans, and their family members in the NYC metro area to join us for this project. Participants will receive a stipend and travel reimbursement for the workshop series and performance.

Please register your interest via this link

bit.ly/E12SoW_InterestForm

Workshops will be held at the Intrepid from 6:30pm – 8:30pm on the following dates:

April 22nd

April 29th

May 6th

May 13th

May 20th

Wednesday, May 29th or Thursday, May 30th (TBC)

The performance is scheduled for the evening of May 31st with the potential for additional showings.

Website: https://docs.google.com/forms/d/e/1FAIpQLSdw67oMXmYGOM5zfDTk1pfhBtSAiQMC2idOc7LJ32G4BtbO4A/viewform

Intrepid Sea, Air & Space Museum

Pier 86, W 46th St

New York

NY 10036

4/15/2024 Virtual Job Interview Preparation | Powered by SDWP Collaboration

Cost: Free

**Please note that the time listed directly below is Pacific Time**

When: April 15, 2024 from 12:00 PM to 01:00 PM EDT

Associated with Blue Stars Career Community

Gain confidence by learning how to effectively communicate your skills. Join us for a one-hour, virtual job interview workshop. Discover the five stages of the interview process, learn how to answer the dreaded weakness question and create an impressive elevator pitch. Monday, April 15 | 9–10 a.m. Pacific Time.

Workshop powered by SDWP – https://workforce.org/events/

ONLINE INSTRUCTIONS

URL: https://workforce-org.zoom.us/meeting/register/tZMvdOCtqTIuHdR0wTxdeMlJy7lX0tVKrUXj#/registration

Website: https://neighborhood.bluestarfam.org/events/82777

Virtual

Zoom

4/15/2024 First Responders Gathering

Cost: Free

Gathering: First Responders

Our First Line peer gathering is for Law Enforcement, Fire & Rescue, EMS, Dispatchers, Corrections, and Federal Agents.

Our in-person gatherings are led by Pastor Andrew Columbia, who served as an NYC Police Officer, served as part of the Ground Zero Clergy Task Force during & after 9/11, now serves as the Lead Pastor of MCB Church in Carmel, and is a Chaplain with the Putnam County Sheriff’s Department & Kent Police Department in Carmel.

These gatherings are an open forum and offer an opportunity to listen, learn, and share what’s on your mind.

WHEN: Monday, April 15 @ 7 – 8:30 pm ET

WHERE: Mt. Carmel Baptist Church, Carmel, NY

RSVP

Website: https://www.guardianrevival.org/calendar/gatherings-2024-04-15-first-line

Mt. Carmel Baptist Church

76 Gleneida Avenue

Carmel Hamlet

NY 10512

Tuesday

Apr 16

4/1/2024 – 5/31/2024 Exit12 Participants for its Next Project in April and May

Cost: Free

*Please note 15-20 participants will be invited to join the project. Fill out the interest form asap*

Following last year’s Truths Colliding workshops, Exit12 and the Intrepid Museum are bringing together a group of veterans, military-connected individuals, and civilians for a series of movement workshops. Over six weeks, Exit12 will hold space for participants to share stories about their service. By sharing these stories we aim to build cross-cultural dialogue, empathy, and healing.

We are looking for military members, veterans, and their family members in the NYC metro area to join us for this project. Participants will receive a stipend and travel reimbursement for the workshop series and performance.

Please register your interest via this link

bit.ly/E12SoW_InterestForm

Workshops will be held at the Intrepid from 6:30pm – 8:30pm on the following dates:

April 22nd

April 29th

May 6th

May 13th

May 20th

Wednesday, May 29th or Thursday, May 30th (TBC)

The performance is scheduled for the evening of May 31st with the potential for additional showings.

Website: https://docs.google.com/forms/d/e/1FAIpQLSdw67oMXmYGOM5zfDTk1pfhBtSAiQMC2idOc7LJ32G4BtbO4A/viewform

Intrepid Sea, Air & Space Museum

Pier 86, W 46th St

New York

NY 10036

4/16/2024 A LinkedIn Workshop for Career Growth: Unlocking Opportunities!

Cost: Free

**Please note that the time listed directly below is Pacific Time**

Date: April 16, 2024 10:00 AM – 11:00 AM PDT

Venue: Blue Star Careers Virtual ZOOM!

WORKSHOP: Network, Network, Network. Use LinkedIn and leverage your connections for job referrals and resources. In today’s competitive market, 85% of professional jobs are “obtained” via networking. Military Spouses can qualify for a year of LinkedIn premium.

In this interactive workshop:

- Optimizing Your Profile: Learn the elements of a compelling LinkedIn profile that effectively grabs attention and communicates your professional story.

- Strategic Networking: Understand the principles of effective networking on LinkedIn, building meaningful connections, and expanding your professional “Human” connections.

- Content Creation: Discover how to create and share content that establishes your expertise, engages your audience, and enhances your credibility in your industry.

- Job Search Strategies: Gain insights into utilizing LinkedIn as a powerful tool for job search, exploring new career opportunities, and positioning yourself as a standout candidate.

This workshop is about leveraging LinkedIn to showcase your unique professional brand and military spouse story. Let’s connect with opportunities that align with your career goals.

**One Year of LinkedIn Premium for Military Spouses is not a BSF Perk, and we do not control the approval process. This workshop will share more details and explain how to request your membership.

Website: https://neighborhood.bluestarfam.org/events/80161

Virtual

Zoom

4/16/2024 Jams: Beacon

Cost: Free

Weekly Beacon Jam Sessions

Our Jam sessions are outlets for guardians to explore & enjoy music and build meaningful relationships.

Hosted by a trained Lead Musician, Jams are designed for community-based music experiences.

Guardians of any skill level are welcome to join — using your own instrument or one of ours.

WHO: Guardians only (veterans & first responders)

We welcome all guardians (active & retired): Veterans, Active Military, Reserve, National Guard, Law Enforcement, Fire & Rescue, EMS, Dispatchers, Corrections, and Federal Agents

WHEN: Tuesdays @ 6 – 8 PM ET

WHERE: Guardian Revival HQ, Veterans Memorial Building

413 Main St, Beacon, NY 12508

Downstairs hall / stage

RSVP

Website: https://www.guardianrevival.org/calendar/2024-04-16-jams-beacon

Guardian Revival HQ – Veterans Memorial Building

413 Main St

Downstairs hall / stage

Beacon

NY 12508

4/16/2024 Writing Workshop

Cost: Free

Writing Workshop

Engage with literature & writing in a fun and friendly atmosphere. Some of us think that writing is only for writers — but writing is for all of us.

As Julia Cameron notes in her book The Right to Write: An Invitation and Initiation into the Writing Life, “I believe we all come into life as writers.” Whether it’s poetry, songwriting, or storytelling, the freedom to express and record through written language is a powerful thing. Join us at one of our writing workshops to discover, create, and express freely on whatever platform suits you best.

Hone your skills through exposure and analysis of fictional and non-fictional literature, as well as learning grammatical tips and tricks. In past workshops, we’ve discussed Theodore Roosevelt’s “The Man in the Arena” quote, the concept of “The Road Less Traveled”, “The Rose that Grew from Concrete” by Tupac Shakur, a poem by our very own Karl Rohde, and the “Invictus” poem by William Ernest Henley.

The goal is to explore writing as a wellness tool & creative outlet. Mike adjusts each workshop to the participants each time. We hope you’ll join our next session!

WHEN: Tuesday, April 16 @ 6:15 – 7:45 PM ET

WHERE: Hybrid

Zoom

Mahopac Public Library, 3rd Floor, 668 U.S. 6, Mahopac, NY, 10541

ZOOM RSVP

MAHOPAC RSVP

Website: https://www.guardianrevival.org/calendar/2024-04-16-writing-workshop

Mahopac Public Library

668 U.S. 6

3rd Floor

Mahopac

NY 10541

Wednesday

Apr 17

4/1/2024 – 5/31/2024 Exit12 Participants for its Next Project in April and May

Cost: Free

*Please note 15-20 participants will be invited to join the project. Fill out the interest form asap*

Following last year’s Truths Colliding workshops, Exit12 and the Intrepid Museum are bringing together a group of veterans, military-connected individuals, and civilians for a series of movement workshops. Over six weeks, Exit12 will hold space for participants to share stories about their service. By sharing these stories we aim to build cross-cultural dialogue, empathy, and healing.

We are looking for military members, veterans, and their family members in the NYC metro area to join us for this project. Participants will receive a stipend and travel reimbursement for the workshop series and performance.

Please register your interest via this link

bit.ly/E12SoW_InterestForm

Workshops will be held at the Intrepid from 6:30pm – 8:30pm on the following dates:

April 22nd

April 29th

May 6th

May 13th

May 20th

Wednesday, May 29th or Thursday, May 30th (TBC)

The performance is scheduled for the evening of May 31st with the potential for additional showings.

Website: https://docs.google.com/forms/d/e/1FAIpQLSdw67oMXmYGOM5zfDTk1pfhBtSAiQMC2idOc7LJ32G4BtbO4A/viewform

Intrepid Sea, Air & Space Museum

Pier 86, W 46th St

New York

NY 10036

4/17/2024 Volunteer Opportunity: Essentials Market Delivery @ Fort Wadsworth

Cost: Free

When: April 17, 2024 from 10:00 AM – 02:00 PM EDT

Join us for a volunteer opportunity at the Nourish the Service Essentials Market by Blue Star Families!

What to anticipate:

- Volunteers are needed from 10 AM to 2:00 PM.

- Deliveries will be arriving from Amazon, local grocery stores, and community partners.

- Tasks include unloading deliveries, carrying boxes upstairs to the market, unpacking boxes, and organizing shelves.

Preparations for volunteer days:

- Wear closed-toed shoes.

- Dress in comfortable attire that you don’t mind getting dirty.

- Bring extra water for yourself.

WHEN: April 17th, 10:00 AM – 2:00 PM

WHERE: 2nd Floor, Family Meeting Center – Fort Wadsworth, 455 USS Tennessee Rd, Staten Island, NY 10305

Website: https://neighborhood.bluestarfam.org/events/82643

Fort Wadsworth

455 Tennessee Rd

2nd Floor of Family Meeting Center

Staten Island

NY 10305

4/17/2024 Gathering: Wellness Wednesdays

Cost: Free

Gathering: Wellness Wednesdays

This peer gathering is open to all guardians — Veterans, Active Military, Reserve & National Guard, Law Enforcement, Fire & Rescue, EMS, Dispatchers, Corrections, and Federal Agents.

Join us for Wellness Wednesdays! This gathering will focus on various topics related to health & wellness, including exercise, nutrition, mindfulness, and sleep.

Hosted by Monty and Kenny, former Navy SEALs and Peer Leaders from Guardian Revival, these gatherings are an open forum and offer an opportunity to listen, learn, and share what’s on your mind.

WHO: Guardians only

WHEN: Wednesdays @ 5 – 6 PM ET

WHERE: Zoom

RSVP

Website: https://www.guardianrevival.org/calendar/gathering-2024-04-17-wellness

Virtual

Zoom

4/17/2024 VITAL (veterans integration to academic leadership) Bi-Monthly Social Event

Cost: Free

Attention, student veterans! Leaving the military to pursue your academic dreams comes with various challenges. Just navigating the vast bureaucracy that is the VA while keeping up academically can seem overwhelming enough. Moving to a new city can also leave you feeling disconnected from the deep sense of community we took for granted in the military. VITAL (Veterans Integration to Academic Leaderships) was created to connect student veterans to the services that the VA provides and to connect vets to each other. VITAL can advise student veterans on everything from educational benefits to military disability claims. We help you navigate the VA so that all you have to focus on is your academic success.

VITAL also connects student Vets in NYC, and we currently host Bi-monthly social events open to all student Veterans in the greater NYC area. The events are usually hosted at 1020 Bar (1020 Amsterdam Ave, New York, NY 10025). The next dates are April 3rd and the 17th at 6 pm. Check the newsletter for additional dates and upcoming summer social events. To get in touch with us, email DR B at [email protected]. Be sure to follow us on Instagram at VITALstudentvets

1020 Bar

1020 Amsterdam Ave

New York

NY 10025

Thursday

Apr 18

4/1/2024 – 5/31/2024 Exit12 Participants for its Next Project in April and May

Cost: Free

*Please note 15-20 participants will be invited to join the project. Fill out the interest form asap*

Following last year’s Truths Colliding workshops, Exit12 and the Intrepid Museum are bringing together a group of veterans, military-connected individuals, and civilians for a series of movement workshops. Over six weeks, Exit12 will hold space for participants to share stories about their service. By sharing these stories we aim to build cross-cultural dialogue, empathy, and healing.

We are looking for military members, veterans, and their family members in the NYC metro area to join us for this project. Participants will receive a stipend and travel reimbursement for the workshop series and performance.

Please register your interest via this link

bit.ly/E12SoW_InterestForm

Workshops will be held at the Intrepid from 6:30pm – 8:30pm on the following dates:

April 22nd

April 29th

May 6th

May 13th

May 20th

Wednesday, May 29th or Thursday, May 30th (TBC)

The performance is scheduled for the evening of May 31st with the potential for additional showings.

Website: https://docs.google.com/forms/d/e/1FAIpQLSdw67oMXmYGOM5zfDTk1pfhBtSAiQMC2idOc7LJ32G4BtbO4A/viewform

Intrepid Sea, Air & Space Museum

Pier 86, W 46th St

New York

NY 10036

4/18/2024 Eco-Hero Virtual Story Time: “Wonder Woman Saves the Trees”

Cost: Free

When: April 18, 2024 5:00 PM – 6:00 PM ET

Associated with CRAIG NEWMARK NY TRI-STATE CHAPTER

Eco-Hero Virtual Story Time: “Wonder Woman Saves the Trees”

Join the Craig Newmark NY Tri-State Chapter, United Through Reading, and Wonder Women for a virtual story time. Let’s celebrate your military children and Earth Day together virtually! Wonder Woman will be reading to the children, and we will learn why celebrating Earth Day is important! More interactive children’s activities will take place during the Zoom call, along with learning more about United Through Reading!

“Wonder Woman Saves the Trees” books will be sent via mail before the event. One book per family. The Zoom link will be provided before the event. This is a chance registration, and spaces are limited.

“It’s not about what we deserve, it’s about what we believe,” ~ Wonder Woman

Website: https://neighborhood.bluestarfam.org/events/81080

Fort Wadsworth

455 Tennessee Rd

2nd Floor of Family Meeting Center

Staten Island

NY 10305

4/18/2024 Factors to Consider When Making the Survivor Benefit Plan Decision

Cost: Free

Date: April 18, 2024 6:00 PM – 7:00 PM ET

National Capital Region Chapter

Join Blue Star Families for the next free Transition Topic Webinar hosted by Navy Mutual.

Factors to Consider When Making the Survivor Benefit Plan Decision

Thursday, April 18th from 6:00-7:00 PM ET via Zoom

The Department of Defense (DoD) Survivor Benefit Plan is a very misunderstood program within DoD. As members approach retirement they routinely ask financial counselors “is SBP a good idea?” The reality is there is no “One Shoe Fits All” answer, and it can be a complicated question to navigate. Whether or not SBP is a good decision depends on many factors including the value of the benefit, personal assets, income needs and more.

This session will explore the questions service members need to ask themselves to understand their unique financial situation and determine if SBP is a good choice for them individually. We will also evaluate tools and calculators that can provide them unbiased information to help them feel confident with their decision and determine the pros and cons of the SBP decision as it applies to them.

Website: https://neighborhood.bluestarfam.org/events/80772

Virtual

Zoom

4/18/2024 Empowerment Workshop for Veterans

Cost: Free

More than a peer support group!

Better than a writing workshop!

Discover the Power of an Empowerment Workshop!

WVE&T facilitates workshops to practice skills in every day life !

~Learn to empower yourself from within your experiences, don’t let them hold you down.

~Build yourself up, learn to Thrive instead of just surviving each day

~Reconnect with family/loved ones by applying skills from workshop into relationships

~Schedule time for yourself without apologies

~Practice observing your inner thoughts without judgment

Give it a try!

Free, Ongoing, Virtual

Previous artistic/writing experience not necessary.

Website: https://www.womenveteransempowered.org/event-info/all-veterans-empowerment-workshop-2024-04-18-18-30

Virtual

Zoom

4/18/2024 Taller de Currículum (virtual) – Resume Workshop En Español

Cost: Free

**Please note that the time listed directly below is Pacific Time**

When: April 18, 2024 from 07:00 PM – 08:00 PM EDT

Associated with Blue Stars Career Community

Unirse a un taller virtual interactivo gratuito de una hora para explorar las últimas estrategias que lo ayudarán a sobresalir en el mercado laboral actual.- Thursday, April 18 | 4–5 p.m. Pacific Time

- Compara y contrasta los tipos de currículum.

- Obtenga información sobre el formato y las secciones críticas.

- Explorar herramientas en línea gratuitas para identificar habilidades, palabras clave e incluso regístrese para una revisión gratuita de su currículum.

Este Taller estará disponible en español e inglés.- Powered by SDWP.

Workshop in Spanish: Join a free one-hour interactive virtual workshop to explore the latest strategies to help you stand out in today’s job market. Compare and contrast resume types. Learn about formatting and critical sections. Explore free online tools to identify skills, keywords, and even sign up for a free resume review.

ONLINE INSTRUCTIONS

URL: https://workforce-org.zoom.us/meeting/register/tZYrdeiqqjssHdIZp_ERqJxcOviCBZS41lAk#/registration

Website: https://neighborhood.bluestarfam.org/events/82780

Virtual

Zoom

4/18/2024 Music Theory 101

Cost: Free

Music Theory 101

Come learn more about music theory — starting with the basic elements that create & define what music is & how it works: notes, scales, chords, rhythm, melody, harmony, and form.

Encore’s new virtual series, Beyond the Soundboard, offers events that dig deeper into music — from theory & history to practical lessons & tips — to help you connect more with the healing power of music.

Whether you are a musician or just interested in learning more about music, this event will provide insight into the world of music as a human phenomenon.

WHEN: Thursday, April 18 @ 7 – 8 PM ET

WHERE: Zoom

RSVP

Website: https://www.guardianrevival.org/calendar/2024-04-18-music-theory

Virtual

Zoom

4/18/2024 Yoga for Everyone

Cost: Free

Yoga for Everyone

A veteran herself, Janel teaches yoga with the aim of training the mind, body, and spirit to heal.

Yoga has been shown to offer improvements for depression, sleep, and life satisfaction. Explore & experience the benefits of yoga with Janel — increased flexibility, muscle strength & tone, a balanced metabolism, and improved cardio & circulatory health.

Join our next yoga session with Janel to help relax & strengthen both your body & mind.

WHEN: Thursday, April 18 @ 7 pm ET

WHERE: Zoom

Note:

- Participate with your camera on or off

- Wear comfortable clothing for movement

- No prior experience with yoga necessary!

Props:

- Space to stretch & move

- Yoga or exercise mat

- Yoga blocks, if available

- Blanket or towel for padding as needed

RSVP

Website: https://www.guardianrevival.org/calendar/2024-04-18-yoga

Virtual

Zoom

Friday

Apr 19

4/1/2024 – 5/31/2024 Exit12 Participants for its Next Project in April and May

Cost: Free

*Please note 15-20 participants will be invited to join the project. Fill out the interest form asap*

Following last year’s Truths Colliding workshops, Exit12 and the Intrepid Museum are bringing together a group of veterans, military-connected individuals, and civilians for a series of movement workshops. Over six weeks, Exit12 will hold space for participants to share stories about their service. By sharing these stories we aim to build cross-cultural dialogue, empathy, and healing.

We are looking for military members, veterans, and their family members in the NYC metro area to join us for this project. Participants will receive a stipend and travel reimbursement for the workshop series and performance.

Please register your interest via this link

bit.ly/E12SoW_InterestForm

Workshops will be held at the Intrepid from 6:30pm – 8:30pm on the following dates:

April 22nd

April 29th

May 6th

May 13th

May 20th

Wednesday, May 29th or Thursday, May 30th (TBC)

The performance is scheduled for the evening of May 31st with the potential for additional showings.

Website: https://docs.google.com/forms/d/e/1FAIpQLSdw67oMXmYGOM5zfDTk1pfhBtSAiQMC2idOc7LJ32G4BtbO4A/viewform

Intrepid Sea, Air & Space Museum

Pier 86, W 46th St

New York

NY 10036

4/19/2024 Power Your Job Search with Google Tools!

Cost: Free

When: April 19, 2024 from 03:00 PM – 04:00 PM EDT

Associated with Blue Stars Career Community

Power Your Job Search with Google Tools is an “on demand” pre-recorded session – TO REGISTER: Please add your name by responding to: “Are You Attending?”. Select YES to get access to recorded session to watch at your convenience!

Master the skills needed for applying to your next job to have your resume, cover letter and application stand out to employers. This will allow you to highlight your skill set to make you more marketable. After completing this learning path, you will be able to:

- Conduct a successful job search using digital tools.

- Create an effective resume that highlights your experience and achievements using a template from Google Docs.

- Edit your resume to make it stronger and more appealing to an employer.

- Explain your skills and experiences to a potential employer by writing a compelling cover letter in Google Docs

- Highlight your military experience on a civilian resume by editing and updating details in Google Docs

Power Your Job Search with Google Tools is an ON-Demand & a recorded session – when you RSVP, please allow 24 hours to receive access to the link to watch.

Website: https://neighborhood.bluestarfam.org/events/82135

Virtual

Zoom

Saturday

Apr 20

4/1/2024 – 5/31/2024 Exit12 Participants for its Next Project in April and May

Cost: Free

*Please note 15-20 participants will be invited to join the project. Fill out the interest form asap*

Following last year’s Truths Colliding workshops, Exit12 and the Intrepid Museum are bringing together a group of veterans, military-connected individuals, and civilians for a series of movement workshops. Over six weeks, Exit12 will hold space for participants to share stories about their service. By sharing these stories we aim to build cross-cultural dialogue, empathy, and healing.

We are looking for military members, veterans, and their family members in the NYC metro area to join us for this project. Participants will receive a stipend and travel reimbursement for the workshop series and performance.

Please register your interest via this link

bit.ly/E12SoW_InterestForm

Workshops will be held at the Intrepid from 6:30pm – 8:30pm on the following dates:

April 22nd

April 29th

May 6th

May 13th

May 20th

Wednesday, May 29th or Thursday, May 30th (TBC)

The performance is scheduled for the evening of May 31st with the potential for additional showings.

Website: https://docs.google.com/forms/d/e/1FAIpQLSdw67oMXmYGOM5zfDTk1pfhBtSAiQMC2idOc7LJ32G4BtbO4A/viewform

Intrepid Sea, Air & Space Museum

Pier 86, W 46th St

New York

NY 10036

4/20/2024-4/21/2024 Fieldcraft 101 | Spring

Cost: Free